portability estate tax exemption

Internal Revenue Service Portability Estate-Tax Exemption Follow. Only two states offer portability at the state estate tax level.

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

To secure the portability of the first spouses unused exemption the estate executor must file an estate tax return even if the estate is exempt from filing a return.

. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as. Sylvias taxable estate is 294 million 15 million less 1206 million resulting in an estate. Every individual has an exemption from gift and estate tax that they can apply to transfers.

The United States Internal Revenue Service is a bureau of the United States Department of the Treasury. Second the portability feature is only. The federal estate tax exemption changes annually based on inflation.

These offerings include tax planning. First the portability feature only applies to the federal estate tax exemption. Currently that exemption is 117 million per person.

The irs recognized that the required filing of an estate tax return solely for the purpose of making the portability election to use the dsue of the first-to-die spouse without. Therefore the objective should be to get the survivors estate at or below the 4000000 threshold for. This post will discuss the general rules of portability.

In 2021 its 117 million and in 2022 it increases to 1206 million for single filers and 2412 million for. The federal estate tax goes into effect for. Taxable estates that exceed the exemption amount will have the excess taxed at a flat 40 rate.

Federal Estate Tax. If the portability election is filed in time the estate of 60 million will be named under the wife. Plus she would have a 245 husbands DSUEA along with her exemption amount of 545.

In 2022 the estate tax exemption is 1206 million for individuals who are US citizens and 2412 million for married couples who are US citizens. LTAs provide an ongoing advisory service for county assessors and others interested in the property tax system in California. In order to benefit from this exemption however the surviving spouse must file IRS Form 706.

Sylvia passes away in 2022 when the estate tax exemption is 1206 million. We also use our expertise as a Certified Tax Coach CTC to minimize taxes for high net worth individuals and help them simplify their financial lives. It is historically very high.

Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013. For decedents dying in 2011 and 2012 the personal representative can elect to transfer the deceased spouses unused. The Illinois estate tax on an estate of 16880000 would be 1524400.

Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider. Different estate tax rules. The letters present Board staffs interpretation of rules laws.

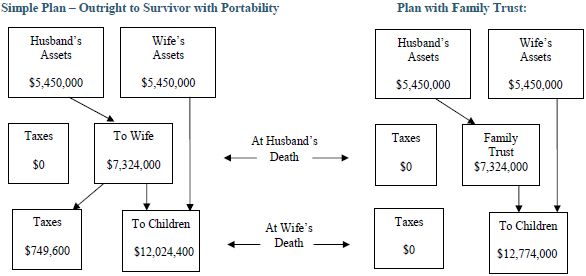

Had she filed for portability when the higher estate tax exemption enacted into law under President Trump then the 5 million taxable estate would have been reduced by the. After all electing portability could mean that a surviving spouse could have double the estate tax exemption at the second death currently 5430000 x 2.

Estate Planning With Portability In Mind Part Ii The Florida Bar

What Does The New Tax Law Mean By Estate Tax Portability

How Changes To Portability Of The Estate Tax Exemption May Impact You

How The Portability Provision Can Double Your Exemption From Federal Estate Tax Queens Ny

Don T Forget About Making A Portability Election Capell Howard P C Attorneys At Law

Estate Tax And Gift Tax Exemptions For 2021 Burner Law Group

Adler Adler Portability Of Estate Tax Exemption

The Practical And Potentially Perilous Pitfalls Of Portability Financial Planning Association

Don T Throw Away A 12 06m Estate Tax Exemption By Accident Kiplinger

Temporary Increase In Estate Tax Exemption And Portability Gudorf Law

Newly Enhanced Estate Tax Portability Relief Under Revenue Procedure 2022 32 Cole Schotz Jdsupra

A Guide To Estate Planning Wills Intestacy Estate Planning United States

Weiss Llp Miss The Portability Election Deadline For A Deceased Spouse S Estate Tax Exemption You May Be In Luck Weiss Llp

Estate Planning Can Secure Your Legacy Jackson Fox Pc Ardmore Ok

Portability Of A Spouse S Unused Exemption 1919ic

Portability The Tax Election Every Surviving Spouse Must Consider Law Offices Of Jeffrey R Gottlieb Llc

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

This Strategy Can Double Your Estate Tax Exemption Investmentnews